The global care economy, estimated at over USD 11 trillion, stands at a critical juncture. It faces unprecedented workforce challenges that demand innovative solutions. As global populations age and healthcare needs evolve, organizations across the care economy must grapple with multiple challenges, none more formidable than those workforce-related. Pain points are numerous and complex, including cross-border labor mobility, labor hoarding, the “care drain”, wage disparities, an informal workforce, and skills deficits across all sub-segments. Worldwide, the care economy faces an estimated labor shortage of 475 million formal workers by 2030.

This blog post explores the multifaceted nature of the care economy worldwide, delving into the various business segments that comprise this key sector. We provide an overview of workforce challenges in the care economy across 5 key regions: North America, Europe, Latin America, Asia-Pacific, and Africa. Also, we provide country-specific examples, highlighting the unique demographic shifts, healthcare access issues, and aged economy concerns in each region. Finally, we present an in-depth look at Deel, an innovative global workforce management platform. The breadth and depth of workforce solutions from Deel enable organizations worldwide to take a holistic view and leverage global talent to build winning business strategies in the care economy. Be sure to follow us on LinkedIn. Now, let’s get started.

Disclosure: At ClearSky 2100 Ventures, our portfolio partly consists of affiliate partnerships. We may earn a small commission from buying links on our site at no cost to you.

The World Population is Aging

The world is experiencing an unprecedented demographic shift towards an aging population, a trend with profound implications for the care economy and workforce demands. This global aging phenomenon is reshaping societies, economies, and healthcare systems across the globe. Unfortunately, many societies are unprepared for the oncoming demographic shifts.

According to the United Nations, the number of people aged 65 and above is projected to more than double from 761 million in 2021 to over 1.5 billion by 2050. Moreover, this increase is occurring at an unprecedented rate and on a scale never seen before in human history. While population aging is a global phenomenon, its progression and impact vary significantly across regions and countries.

Global Aging Trends

Aging in Developed Markets

Developed regions, such as Europe and North America, are at the forefront of this demographic transition. Japan, for instance, leads the world with 30% of its population aged 65 and above. Many European countries, including Italy, Germany, and Finland, are not far behind, with over 20% of their populations in this age group. These nations are grappling with the challenges of supporting larger elderly populations with smaller working-age cohorts and a growing reliance on healthcare immigration. By 2040, the population decline across the EU is expected to reduce GDP by 4 percentage points, according to global investment bank Morgan Stanley.

Aging in Emerging Economies

Emerging economies, particularly in Asia, are aging at a much faster rate than their developed counterparts did. China, due to its previous one-child policy and rapid economic development, is aging at an extraordinary pace. It’s projected that by 2050, 330 million Chinese will be over 65 – more than the current population of the United States. India, while still relatively young, is also seeing a significant increase in its elderly population, which is expected to triple by 2050.

Latin America and the Caribbean, traditionally known for their young populations, are also experiencing rapid aging. Countries like Chile, Cuba, and Uruguay are leading this trend in the region, with their 65+ populations expected to double by 2050.

Africa remains the world’s youngest continent, but even here, the proportion of older people is growing. While the pace is slower compared to other regions, the absolute number of elderly individuals in Africa is set to grow dramatically, presenting unique challenges for countries with limited healthcare infrastructure. Additionally, the explosive growth of the region’s population, particularly in megacities, will strain resources required to accommodate an aging population.

Implications for the Care Economy

This global aging trend has several key implications for the care economy:

- Increased demand for healthcare and long-term care services: As people live longer, there’s a growing need for chronic disease management, eldercare, and specialized geriatric services. The global elder care market is expected to approach $3 trillion by 2030.

- Pressure on pension systems and social security: Many countries are struggling to finance retirement benefits for larger elderly populations supported by smaller working-age cohorts. Worldwide, the global pension deficit is expected to reach $400 trillion by 2050.

- Changes in the labor market: There’s a growing need for healthcare professionals, eldercare specialists, and other workers in the care economy. By 2030, there will be a need for an additional 475 million workers in the care economy. However, investment would generate an additional 280 million jobs.

- Innovation in care delivery: The aging trend is driving innovations in telehealth, home care technologies, and age-friendly urban design. Aging in place remains the preferred model for habitation worldwide. Over 60% of older adults worldwide prefer to age in place.

- Shift in family dynamics: In many cultures, there’s increasing pressure on families to provide care for elderly relatives, often impacting women’s participation in the formal workforce. In Europe, the value of informal caregiving is estimated at 3.63% of the European GDP.

- Economic opportunities: The “silver economy” presents new market opportunities for products and services catering to older adults.

- Need for policy reforms: Governments worldwide are grappling with how to adapt their health, social, and economic policies to support aging populations. Many governments are taking note, with 76% of governments enacting policies to address their aging population. Some of these include the promotion of active and healthy aging and the encouragement of private savings for retirement.

The global aging trend underscores the critical importance of developing robust, adaptable care economies capable of meeting the evolving needs of older populations. Building a high quality global workforce to address these trends is the key. The next 20 to 30 years are critical. It highlights the need for innovative solutions in workforce management, care delivery, and policy-making to ensure sustainable and high-quality care for aging populations worldwide.

Defining the Global Care Economy

What is the care economy? The global care economy encompasses a vast network of services and activities aimed at supporting and nurturing human life. It includes both paid and unpaid work, ranging from childcare and eldercare to healthcare and social services. This sector plays a crucial role in maintaining the well-being of individuals and communities while also contributing significantly to economic growth and social development. Let’s take a closer look at some of the segments of the care economy.

There are several key business segments in the care economy. These include:

- Healthcare Services: This includes hospitals, clinics, nursing homes, and other medical facilities that provide direct patient care. It also encompasses mental health services, rehabilitation centers, and specialized care for chronic conditions.

- Childcare and Early Education: Daycare centers, preschools, and early childhood education programs fall under this category, providing essential support for working parents and laying the foundation for children’s future development.

- Elder care and Long-term Care: As populations age, services catering to the elderly have become increasingly important. This segment includes retirement communities, home care services, and assisted living facilities.

- Social Services: Organizations providing support for vulnerable populations, such as those with disabilities, homeless individuals, and victims of domestic violence, form an integral part of the care economy.

- Wellness and Personal Care: This segment includes fitness centers, spas, and personal care services that contribute to overall well-being and preventive health.

- Educational Support Services: Tutoring, special education, and adult education programs fall within this category, supporting lifelong learning and skill development.

America’s recent grade of C+ and 29th out of 48th ranking for its pension systems suggests daunting challenges ahead in meeting the needs of its rapidly aging society.

Current Workforce Challenges in the Care Economy

The care economy faces several pressing workforce challenges that hinder its ability to meet growing demand and maintain quality of service:

- Labor Availability: Many care sectors, particularly healthcare and eldercare, face severe staffing shortages. In the United States alone, the healthcare industry is projected to have a shortage of up to 3.2 million workers between 2021 and 2026, according to a report by Mercer. Many of these will be in low-wage occupations (medical assistants, home health aids, nursing assistants, etc)

- Wage Disparities: Despite the essential nature of care work, many jobs in this sector are undervalued and underpaid. This leads to high turnover rates and difficulty in attracting and retaining skilled workers. For example, in the home care industry, turnover rates can reach as high as 80%.

- Skills Deficits: Rapid technological advancements and evolving care needs have created a skills gap in many care professions. There is a growing demand for workers with specialized skills in areas such as gerontology, mental health, and digital health technologies..

- Burnout and Stress: The demanding nature of care work, often exacerbated by understaffing and long hours, leads to high rates of burnout and stress among care workers. This affects both the quality of care provided and the well-being of the workforce.

- Cross-border Labor Migration: While international migration of care workers helps address labor shortages in some countries, it can lead to “care drain” in others, creating complex ethical and policy challenges.

- Lack of Career Progression: Many care jobs, particularly in lower-skilled roles, offer limited opportunities for career advancement, making it difficult to retain talented individuals in the sector.

Regional Overview of Care Economy Workforce Challenges

North America

United States

The United States faces significant challenges in its care economy workforce, driven by an aging population and increasing healthcare needs. By 2030, all baby boomers will be over 65, placing unprecedented demand on the healthcare system. The country faces a projected shortage of up to 86,000 physicians between 2021 and 2036, according to the Association of American Medical Colleges. In the nursing sector, the Bureau of Labor Statistics projects 194,500 average annual openings for registered nurses between 2023 and 2033.

The home care industry is particularly strained, with an estimated 7.8 million new home care jobs expected to be created between 2016 and 2026. However, low wages, lack of benefits, and challenging working conditions make it difficult to attract and retain workers in this sector. The median hourly wage for home health and personal care aides was just $16.12 in 2023, significantly lower than the national median for all occupations.

Unpaid caregiving remains a significant challenge in the United States, with an estimated 36 billion hours of care provided by family caregivers. More importantly, the value of this care provided was estimated at $600 billion in 2021.

Recent legislation passed by Michigan provides home healthcare workers the right to unionize and bargain for higher wages. The Michigan law suggests labor complexities emerging in the industry but a recognition of the importance of the work. However, this presents new challenges for employers, workers, and patients alike as many laws begin to take hold across the US.

Canada

Canada’s care economy faces similar challenges, with an aging population and increasing demand for healthcare services. The country is experiencing a severe shortage of healthcare workers, particularly in rural and remote areas. The Canadian Nurses Association projects a shortfall of 60,000 full-time equivalent registered nurses by 2022 and over 117,000 nurses by 2030.

In the childcare sector, Canada faces a significant shortage of affordable, high-quality care options. According to recent reports, only one spot in childcare settings was available for 29% of those who needed it. This has been exacerbated by the COVID-19 pandemic, which led to the closure of many childcare centers. The federal government has pledged to create a national childcare program, which could create new job opportunities but also increase the demand for qualified early childhood educators. The country plans to spend CAD 30 billion by 2026 and create over 250,000 new slots.

To address the workforce gaps in the care economy, Canada has taken an aggressive approach to hiring foreign labor. The country offers various immigration programs to attract top healthcare talent from around the world.

Europe

United Kingdom

The UK’s care economy is under significant strain, particularly in the wake of Brexit and the COVID-19 pandemic. The National Health Service (NHS) faces severe staffing shortages, with an estimated 100,000 vacancies across the healthcare system. Recent industrial action by NHS doctors further highlights the challenges engulfing the UK healthcare sector. The social care sector is also struggling, with an additional 440,000 jobs required by 2035 to meet surging demand.

The UK’s aging population is driving increased demand for eldercare services. By 2050, it’s projected that one in four people in the UK will be aged 65 or over. This demographic shift is placing additional pressure on an already strained healthcare system. Low wages and challenging working conditions in the social care sector contribute to high turnover rates, with close to 30% of care workers leaving their jobs each year.

Germany

Germany, Europe’s largest economy, faces significant challenges across its care economy due to its rapidly aging population and low birth rates. Additionally, workforce issues are acute, with staffing shortages in the healthcare sector higher than pre-pandemic levels. For example, 40% of vacancies post-pandemic remain unfilled. In its eldercare sectors, the country continues to experience a severe shortage of care workers, The German Economic Institute estimates that Germany will need an additional 130,000 full-time care workers by 2025 to meet the growing demand.

Over the past decade, the number of migrant doctors and nurses to OCED countries has increased by over 60%.

The shortage of skilled care workers has led Germany to actively recruit from other countries, particularly from Eastern Europe and Asia. In 2022, 16%, or 270,000, of the qualified nurses in Germany were foreign nationals, up from 5% in 2013. However, language barriers and integration challenges often complicate these efforts. The German government has implemented measures to make care professions more attractive, including increasing wages and improving working conditions, free tuition, and family migration, but significant challenges remain.

Latin America

Brazil

Brazil, Latin America’s largest economy, faces significant challenges in its care economy. Like other countries worldwide, its population continues to age. Additionally, significant disparities in healthcare access exist nationwide. The country’s public healthcare system, Sistema Único de Saúde (SUS), struggles with underfunding and staffing shortages, particularly in rural and low-income urban areas. Many of its citizens opt for private healthcare, which accounts for close to 60% of healthcare spending.

The demand for eldercare services is growing rapidly. Over the 2010–2022 period, the number of Brazilians aged 65 and older has risen to 22.2 million from 14.1 million, a 57% increase. By 2050, the number of Brazilians aged 65 and over is expected to double, comprising 22.5% of the total population. By that time Brazil’s elderly (65+) population will be the fourth largest, only behind China, India and the United States

However, the country lacks a comprehensive long-term care policy, and most elder care (over 80%) is provided informally by family members. This creates a significant burden on families and limits economic opportunities, particularly for women, who often bear the primary responsibility for caregiving.

Colombia

Colombia’s care economy is characterized by significant informal care work and regional disparities in access to care services. The country has made strides in expanding healthcare coverage, but shortages of healthcare professionals, particularly in rural areas, remain a significant challenge. The country is also facing the prospect of an aging population, with an expected 10 million senior citizens by 2031, a 41% increase from 2021.

The Colombian government has recognized the importance of the care economy and has implemented policies to support and formalize care work. In 2010, Colombia passed Law 1413, which mandates the inclusion of unpaid care work (21.7% of GDP) in the System of National Accounts. This has helped to highlight the economic value of care work, but challenges in providing adequate compensation and support for care workers persist.

Asia-Pacific

Australia

Australia’s care economy is facing significant workforce challenges, particularly in the aged care and disability sectors. In 2020, the number of Australians aged 65 years and older stood at 4.2 million (16% of the total population). This number is expected to rise to 23% by 2066. Additionally, the number of people aged 80 and over is expected to triple to 3.5 million. The Royal Commission into Aged Care Quality and Safety highlighted severe staffing shortages and quality issues in the aged care sector. It’s estimated that Australia will need an additional 110,000 aged care workers each year through to 2030 to meet growing demand. As the country transitions to an older demographic, key jobs required will include, among others,

- Technology Integration Specialists

- Care Coordinators

- Health and Wellness Coaches

- Aged Care Navigators

- Behavioral Health Specialists

- Robotics Technicians

- Diversity and Inclusion Officers

- Community Engagement Officers

To meet the growing deficit of qualified healthcare workers, the Australian government has instituted various immigration schemes to attract qualified healthcare professionals for travel, work, or migration. Qualified occupations include nurses, medical specialists, midwives, psychologists, pharmacists, etc. Moreover, the recent passage of the Regional Comprehensive Economic Partnership, of which Australia is a signatory, includes various aspects to support the potential of migration or movement of healthcare professionals across the trade bloc; these elements include

- Trade in Services

- Temporary Movement of Persons

- Investment Provisions

- Economic and Technical Cooperation

Favorable provisions to support the cross-border movement of healthcare workers also exist in other trade blocs, such as USMCA and the EU.

Philippines

The Philippines plays a unique role in the global care economy as a major exporter of care workers, particularly nurses and domestic helpers. While this provides significant economic benefits through remittances (8.5% of GDP), it also creates challenges in maintaining adequate staffing levels within the country’s healthcare system.

The Philippines faces a paradoxical situation where it produces more nurses than it can employ domestically, leading many to seek work abroad. This “care drain” can leave local healthcare facilities understaffed, particularly in rural and low-income areas. The government has implemented programs to encourage nurses to work in underserved areas, but challenges persist.

In the childcare sector, the Philippines faces issues of affordability and quality, particularly for low-income families. Many families rely on informal childcare arrangements, which can be inconsistent and may not provide optimal developmental support for children.

Africa

Africa, the world’s youngest continent (median age of 18), is experiencing a unique set of challenges in its care economy. Africa will account for 5 (Nigeria, DRC, Ethiopia, Tanzania, and Egypt) of the 8 countries expected to contribute 50% of the world’s population growth by 2050. While the continent’s population is generally younger compared to other regions, rapid urbanization and the explosive growth of megacities, changing family structures, and gradual increases in life expectancy are creating new demands for care services.

Nigeria

As Africa’s most populous country, Nigeria faces significant challenges in its care economy. By 2050, the country will be home to Lagos, one of the world’s largest megacities. The population of this megacity is expected to reach 40 million by 2050 and 88 million by 2100. The country’s healthcare system is strained by a shortage of healthcare professionals, with many Nigerian doctors and nurses seeking employment abroad. According to the Nigerian Medical Association, there is only one doctor for every 9,083 patients in Nigeria, far below the World Health Organization’s recommendation of one doctor per 600 patients. With an already low doctor-to-patient ratio, over 57,000 nurses left the country to work abroad between 2017 and 2022.

The exodus of healthcare workers, often referred to as “care drain,” is a major concern. A 2017 survey by the Nigerian Polling Organization (NOIPolls) found that 88% of doctors were considering work opportunities abroad. This outflow of skilled professionals leaves significant gaps in the domestic healthcare workforce.

Elder care is an emerging concern in Nigeria. The country is home to the largest elderly population on the continent and the 19th largest elderly population worldwide. Moreover, the percentage of its population 65 and older is expected to rise from 2.8% of the total population in 2020 to 4% by 2050. While traditionally, elderly care has been provided within family structures, urbanization and changing family dynamics are creating a need for formal eldercare services. However, the development of such services is still in its early stages.

In 2021, the country’s Federal Executive Council ratified the National Policy on Ageing for Older Persons in Nigeria. The main objective of the policy is to effectively integrate senior citizens into Nigerian society, ensuring care, comprehensive care, independence and self-fulfillment are preserved.

Tanzania

Tanzania, like many African countries, faces significant challenges in its healthcare workforce. The country has a severe shortage of healthcare professionals, with a doctor-patient ratio of 1:20,000, well below the global guidelines of 1:8,000.

The Tanzanian government has made efforts to improve healthcare access through its Primary Health Care (PHC) approach. However, the shortage of skilled healthcare workers, particularly in rural areas, remains a significant challenge. The country has implemented strategies to train and retain more healthcare workers, including the establishment of more medical training institutions and the introduction of compulsory rural service for newly graduated doctors.

Elder care in Tanzania is primarily provided within family structures, but this is beginning to change with urbanization and evolving family dynamics. Those 60 and older represented 4% of the estimated total population of 61 million. By 2050, this number will rise to 10%. The government has recognized the need to develop formal eldercare services, but progress has been slow due to limited resources and competing healthcare priorities.

By 2050, Brazil will have the fourth largest elderly population (65 and older) behind China, India and the United States.

Challenges Across the Continent

Both Nigeria and Tanzania highlight the current and emerging challenges of the care economy across the continent. Many countries must grapple with the challenge of building robust care economies while also addressing pressing issues of poverty, infectious diseases, and limited healthcare infrastructure. The care economy in these countries is characterized by:

- A significant reliance on informal care is provided by family members, particularly women.

- Limited formal eldercare services, with most care for older adults provided within family structures.

- Challenges in retaining healthcare professionals, with many seeking employment in more developed countries.

- There have been efforts to expand early childhood education and care, but with persistent gaps in quality and accessibility.

- There is a need to balance the development of care services with other pressing healthcare and economic priorities.

As these countries continue to develop, the demand for formal care services is likely to increase, presenting both challenges and opportunities for workforce development in the care economy. What’s clear is that innovative workforce solutions will be required to address current and emerging challenges.

Deel’s Solutions for the Global Care Economy’s Workforce Challenges

The raft of complex workforce challenges suggests a difficult road ahead in meeting the needs of aging populations globally. However, it presents numerous business opportunities for many entrepreneurs and large enterprises. Understanding and harnessing the benefits of a global best-in-class workforce solutions provider creates a competitive advantage for startups, growth companies, and multinationals across various segments of the care economy.

Deel Global Workforce Solutions

Deel, a leading global hiring and payroll platform, offers innovative solutions to address the complex workforce challenges facing the care economy. By leveraging technology and a deep understanding of international employment regulations, Deel enables organizations in the care sector to access global talent pools, streamline their hiring processes, and manage their workforce more effectively. The company offers services in more than 180 countries. It continues to expand rapidly, adding new services and providing a diverse set of solutions across 5 key global workforce strategies, which include:

Global Hiring

Deel’s platform allows organizations to hire employees and contractors in over 150 countries, helping to address labor shortages by tapping into international talent pools. The company has built an extensive offering in supporting independent contractors as well as EOR services. The company’s EOR services are available in over 150 countries, with internal and external teams of expert legal advisors to ensure hiring and onboarding comply with local laws. This is particularly valuable for roles that can be performed remotely, such as telemedicine providers, administrative staff, and certain therapeutic services. For example, a US-based healthcare provider could use Deel to hire skilled nurses from the Philippines, addressing local US shortages while providing employment opportunities for Filipino healthcare workers.

Global Payroll

Managing payroll for a global workforce can be complex, especially in the care sector, where shift work, overtime, and various allowances are common. Additionally, companies continually struggle with multiple systems (up to 6) and inefficiencies utilizing internal and external payroll vendors. These payroll issues risk creating a poor employee experience. Deel’s global payroll solution ensures compliance with local labor laws and tax regulations in multiple countries, simplifying the process for organizations operating across borders. This can be particularly beneficial for multinational care providers or startups engaged in cross-border care initiatives.

Global Immigration Support

For organizations in the care economy looking to relocate workers internationally, Deel offers immigration support services. Many countries facing a shortage of healthcare talent offer special visa programs for key care-related specialties. Additionally, as companies seek to build out technology platforms to serve the markets, the ability to rapidly onboard tech talent is critical. Deel Immigration (formerly Legalpad) can help streamline the process of bringing skilled care workers from countries with surplus labor to those facing shortages. Deel Immigration provides the broadest coverage (40+ countries) with an extensive track record in the United States. For instance, Deel could assist a German eldercare facility in navigating the immigration process for skilled care workers from Eastern Europe or Asia. Key advantages of

Managing Complex Healthcare Immigration

Over the past decade, the number of migrant doctors and nurses to OCED countries has increased by over 60%. The brisk pace of healthcare migration is expected to continue as the global labor pool becomes optimized to address the $11 trillion care economy workforce crisis. Additionally, new migration patterns are emerging, specifically the South-South and North-South. Rapid economic development and middle-class growth are occurring across Global South megacities. Concomitantly, the aged economy is evolving, and the care drain continues. These dynamics are creating a demand for specific healthcare skills not currently present, suggesting growing gaps that will need to be filled.

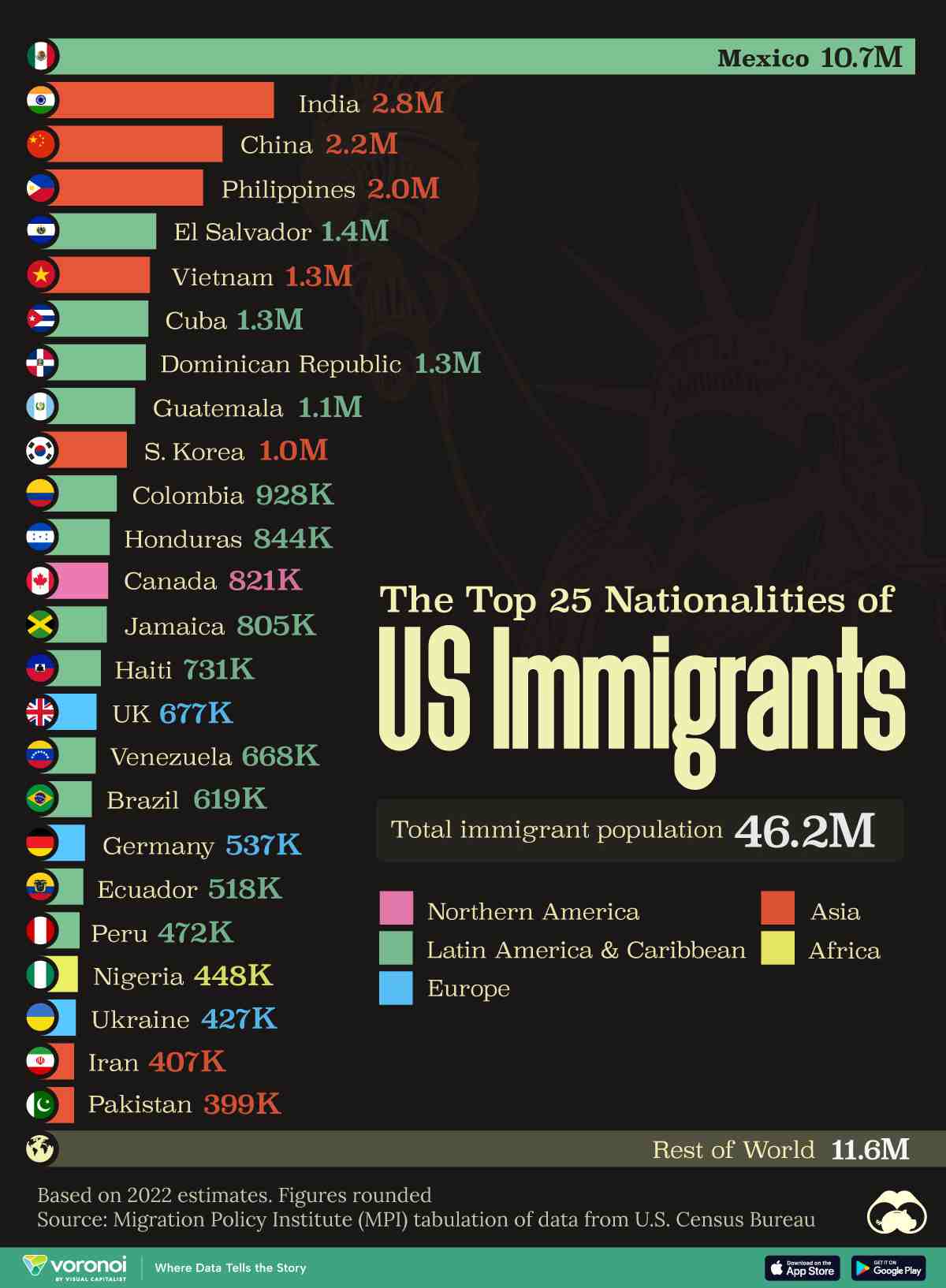

Uptick in Skilled US Migrants

The United States ranks as the #1 country for migration, a position held since 1970. Mexico remains the largest source of immigration, with India, China, the Philippines, and El Salvador rounding out the top 5. Additionally, in 2023, the US maintained its absolute dominance as the world’s leading startup ecosystem, fueled by the growth in investments in AI, IOT, semiconductors, and renewable energy sectors. Moreover, new cities across US Megaregions continue to emerge as startup hubs, e.g., Miami, Columbus, Nashville, etc.

Skilled worker visas such as the EB-2 NIW and the EB-1A green cards are up significantly. Between 2022 and 2023, EB-2 NIW visa issuances rose more than 80% to nearly 40,000 visas. Moreover, the approval rate stands at close to 90%. To support EB-2 NIW and EB-1A applications, Deel Immigration offers

- Personalized Support with an in-house team available 24/7 to advise on the optimal visa path.

- A consolidated platform offering robust security protocols and the ability to track application status.

- Real-time status updates with insights from the case

Global HR Management

Deel’s platform provides comprehensive HR management tools tailored for global workforces. This includes features for managing time off, tracking performance, and ensuring compliance with local labor regulations. For care organizations managing staff across multiple countries, this centralized system can significantly reduce administrative burdens and ensure consistent HR practices. Key features of Deel HRIS include:

- Onboarding

- Document Management

- Time Off and Expenses

- Offboarding

- Workflows

The Deel HRIS offers industry-leading security standards and is compliant with GDPR, SOC2, and ISO 27001 standards. Deel HRIS also comes with the ability to offer custom permissions and approvals, as well as data logs. Additionally, various add-ons, integrations, and APIs are available. For companies with less than 200 employees, the Deel HRIS system is free.

Global Expansion

Business opportunities in the care sector continue to evolve in line with regulatory, policy, and socio-economic developments. As clarity begins to emerge in the sector, we expect many of these business models to become global. M&A activity remains brisk within sub-segments in more developed countries, e.g., the United States. However, expanding internationally can be challenging for companies as they seek to capture opportunities in the global care economy. From building strategic partnerships to capturing new revenue streams, execution is essential. Deel services support companies on global expansion through entity set-up and M&A support.

A World in Transition

Finally, the care economy stands at a crossroads, facing unprecedented challenges in meeting the growing global demand for direct care and care-related services. From severe healthcare labor shortages in North America to the complexities of cross-border healthcare worker migration in Asia-Pacific, each region grapples with unique workforce issues. These issues are shaped by demographic shifts, economic factors, and challenging policy and regulatory landscapes. To capture opportunities as they emerge, speed, flexibility, and scale are key. The need for innovative solutions has never been more pressing.

Deel’s comprehensive suite of global workforce management tools offers a promising pathway for addressing these challenges. By enabling organizations to access global talent pools, streamline their hiring and payroll processes, and navigate complex international regulations, Deel empowers the care sector to build more globally, resilient, and flexible workforces. The platform’s ability to facilitate cross-border hiring and manage diverse international teams is particularly valuable in addressing regional imbalances in care worker supply and demand.

As we look to the future, it’s clear that solving workforce challenges in the care economy will require a multifaceted approach. While technological solutions like Deel play a crucial role, they must be complemented by policy initiatives, investments in education and training, and efforts to improve working conditions and career pathways in the care sector. By leveraging global resources and innovative management tools while also addressing local needs and cultural contexts, it’s possible to build a more sustainable care economy that meets the needs of populations worldwide.